Global stocks in freefall mode as economic collapse unfolds

08/24/2015 / By Carol Young

China, the world’s second-largest economy, continues to show signs of a sharp slowdown, unnerving investors everywhere as markets begin falling worldwide.

According to Jim Cramer, the Chinese market needs to reset. By his estimation, the Shanghai Composite Index needs to lose 35 to 40 percent of its value. Before that happens, if it does, he warns that there are U.S. companies with stocks which are vulnerable to China’s decline.[1] Another question to consider is what the Federal Reserve’s ultimate decision will be concerning interest rates. Markets must be stable before an interest-rate hike, but as the Dow continues to fall, that scenario seems unlikely:

“The Chinese have created an air of fragility around the globe. Markets will now surely have to firm up considerably for the Fed to pull the trigger next month,” said Deutsche Bank analyst Jim Reid.[2]

Natural News‘s Mike Adams warned readers on Aug. 17 about the serious potential for worldwide market collapse:

If this covert war between China and the United States continues to escalate, it would ultimately devastate the economies of both nations. Both China and the USA are currently experiencing shockwaves in their stock markets as bubble economies built on debt begin to unravel.

In these times of shaky financial foundations, it doesn’t take much to topple public faith and unleash a mass exodus away from currencies and markets. It’s also clear that the United States considers currency games to be acts of war while justifying “kinetic responses” to such events.[3]

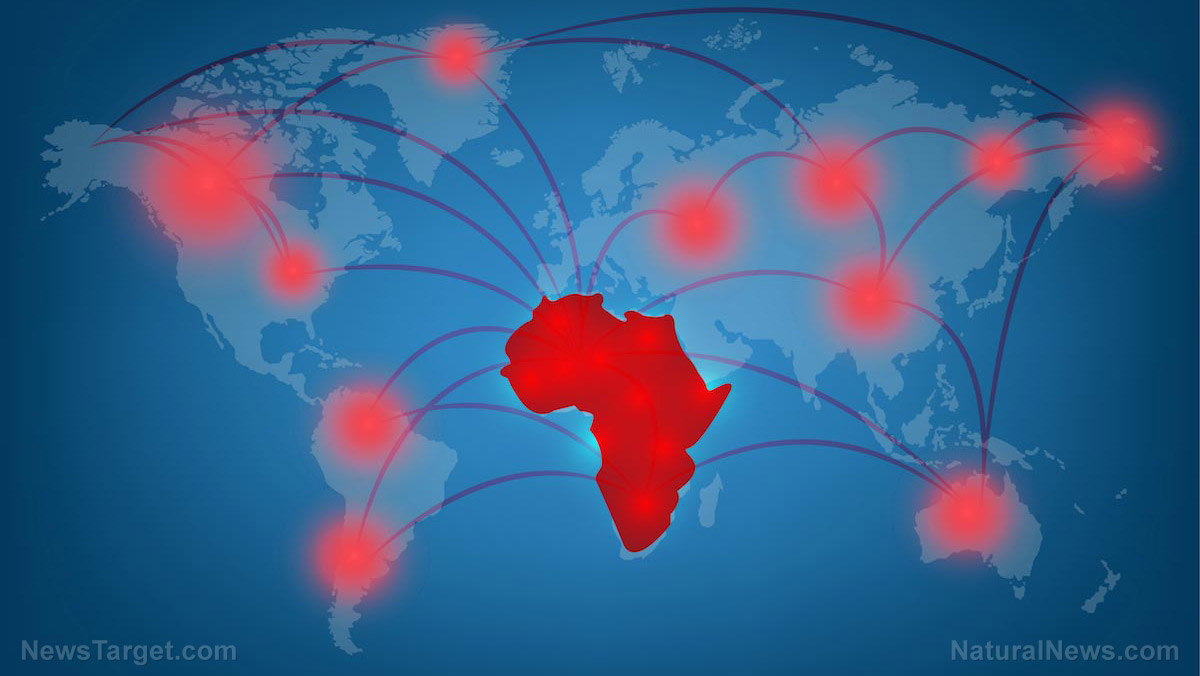

Economic collapse hits worldwide

Today’s market is flashing red warning signals not just about what the stock market will be doing for the immediate future but also about the prospects for deflation and possible recession in China. Ron Isana, reporter for Market Score Board Report and CNBC said:

China’s policymakers, unlike in prior slowdowns, cannot simply build their way out of this slump. In fact, while many in America worry about the Fed having no tools left to fight the next crisis, or recession, that is even more true in China.

In a real recession, infrastructure spending in China would be redundant. Currency devaluation may have less of an impact than in prior cycles, and large-scale bond buying programs would simply move one form of government debt from municipalities and state-owned enterprises to the central government’s balance sheet.[4]

The currency of emerging economies are taking the hardest hit, as reported by The Associated Press: Kazakhstan’s currency plummeted this week after the government decided to let it trade freely. The South African rand fell this week to a 14-year-low against the U.S. dollar. Turkey’s lira hit a record low against the dollar this week.[5]

If you are looking for a thorough explanation of what is happening with the economy, the imminent economic collapse and the looming global financial crisis, then you need to watch this video narrated by Natural News‘s Mike Adams. It not only lays out what the mainstream media isn’t telling you but also gives hope for how you can reduce your systemic risk in the next stock market crash. Essentially, the video serves to inform you about how you can protect yourself against the current economic crash, which may be happening sooner than you think. It also explains how everything the mainstream media tells you can be egregiously misleading and is simply trying to distract you from the truth.

Watch the following video by Mike Adams to find out what to expect in the next crash which threatens to be even bigger than the one we experienced in 2007 and 2008:

After watching this video, be sure to stay on top of what is truly happening in the markets. You will find unfiltered articles (as well as articles being published by the mainstream media) at MarketCrash.news, powered by FETCH.news.

(1) CNBC.com

(2) WSJ.com

(3) NaturalNews.com

(4) CNBC.com

(5) FoxNews.com

Tagged Under: economic collapse, financial system, global stocks

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 COLLAPSE.NEWS

All content posted on this site is protected under Free Speech. Collapse.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Collapse.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.