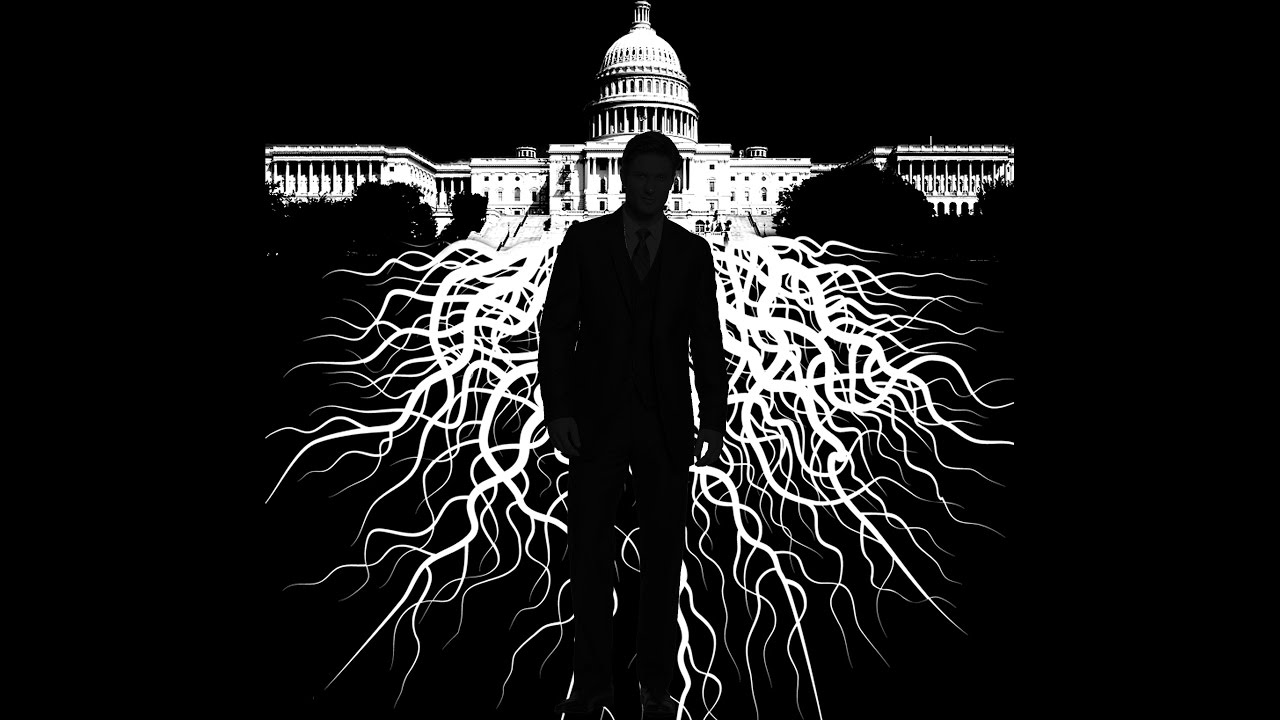

Why did this reporter “disappear” after predicting the collapse of oil prices?

08/11/2015 / By collapsenews

He managed to forecast the current collapse in oil prices, and then he went missing. It’s been a year now.

His name is David Bird, and he is a reporter who covered energy markets for The Wall Street Journal. First, some background.

According to the blog Wall Street on Parade, Bird told his wife on a wintry afternoon about a year ago that he was headed out the door for a walk. He left his Long Hill, New Jersey, home in a red jacket with yellow zippers. Despite this colorful outerwear, and despite the searching by hundreds of volunteers and law enforcement officers, as well as the FBI, Bird disappeared without a trace.

As the website had reported in January 2014:

[F]or the three months prior to his disappearance, Bird was reporting on a supply glut and growing stockpiles of oil. A newly retrieved article by Bird that appeared on line at The Wall Street Journal on August 21, 2013, shows the reporter had also presciently made an early connection between the Federal Reserve ending its massive bond-buying program known as “quantitative easing” [QE] and a potential crash in the price of oil — a crash that has now cut the price of oil almost in half in the past six months.

Growth of dollar, easing of QE, cheap oil

In an Aug. 21, 2013 piece, Bird wrote:

“Crude-oil futures fell after the minutes from the Federal Reserve’s latest policy meeting heightened concerns that less economic stimulus could hit demand for the fuel.

“Traders are worried that the end of the $85 billion-a-month bond-buying program will cause dollar-based crude prices to rise in local-currency terms, choking off economic growth in India, Indonesia and other emerging markets that has fueled a rise in global oil consumption in recent years…

Sponsored solution from the Health Ranger Store: The Big Berkey water filter removes almost 100% of all contaminants using only the power of gravity (no electricity needed, works completely off-grid). Widely consider the ultimate "survival" water filter, the Big Berkey is made of stainless steel and has been laboratory verified for high-efficiency removal of heavy metals by CWC Labs, with tests personally conducted by Mike Adams. Explore more here.

“‘All this tapering talk is absolutely deadly for emerging markets’ because of its effect on the dollar, [Bill O’Grady, Chief Market Strategist at Confluence Investment Management] said. ‘We could see [oil] demand really tail off.'”

Could talk from Fed officials that the American economy was becoming strong again — strong enough, in fact, to produce and grow without the regular cash injections via QE — impact oil consumption in emerging markets, as well as the U.S. dollar (the latter of which has been rising against global currencies)?

Some financial experts, Wall Street on Parade noted, believe that such talk could: If the U.S. economy no longer needs QE, then interest rates are bound to rise as a reflection of a stronger economy. As they do, this is likely to attract investment inflows into the U.S. “to capture the higher yields at a time when other developed countries are setting record low yields on their bonds,” the site reported.

It added that increasing inflows of capital result in boosting the value of the dollar.

The oil economics reporter who knew too much?

The Wall Street analysis site continued:

What Bird hit upon, however, was the uncharted waters of the Fed’s unprecedented and massive pump-priming operation which has quadrupled its balance sheet to over $4 trillion since the financial crash of 2008. How does one exit a stimulus program of that dimension without creating waves — or tsunamis — in interlinked markets?

The answer could be that fallout from the Fed’s backing off of QE will be very painful, and indeed, is already reflecting such pain in commodities’ prices (like oil). Bird, it seems, was prophetic early on regarding how he saw everything playing out.

Here’s something else: Oil is priced in dollars (because the dollar is the world’s reserve currency), so as prices collapse in the U.S. and the dollar rises, purchasing oil will become more expensive for other countries.

So, what could have happened to David Bird? Why would predicting the nexus of the easing of QE and collapsing of oil prices potentially be hazardous to one’s health?

It’s possible, say various reports, that what is coming down the road economically — massive consolidation in the oil industry, for instance (as a matter of economic survival), and in the markets — is not a secret that the monied interests really want told.

Read up on Bird’s disappearance and what it could mean here and here. A local New Jersey report on Bird’s disappearance is here.

Sources:

Tagged Under: