“Just close the whole thing up”: CNBC anchors melt down, beg for market closures on Twitter

03/17/2020 / By News Editors

Few are dealing with the economic and market turmoil with more chaos and less class and resolve than the expert “buy and hold” class over at CNBC, who shockingly never said one word of warning to their retail viewers when the market was doing nothing but going straight up for more than a decade, and instead were dragging mom and pop investors into massively overvalued stocks urging them to buy at all time highs, and who are now melting down before our eyes at the first sight of a substantial market pullback.

(Article by Tyler Durden republished from ZeroHedge.com)

Their solution: own the shorts by shutting down the market entirely. Because if one can’t BTFD, is it even a market?

As recently as Friday, when the Dow Jones posted a 2000 point gain on the back of a short squeeze that nearly doubled the indexes gains in the last 15 minutes of the day, there was no talk about markets being defective or needing to close. That was, of course, until the Fed’s $700 billion “quarantative easing” bazooka bailout of markets fizzled spectacularly on Sunday nights and futures promptly went limit down. When it appeared that this plan was failing, some of the industry’s finest began to panic visibly.

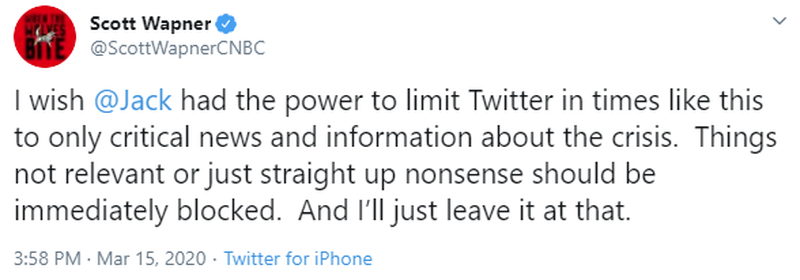

Prior to the Fed news, Halftime Report’s Scott Wapner had already called for blanket censorship of Twitter…

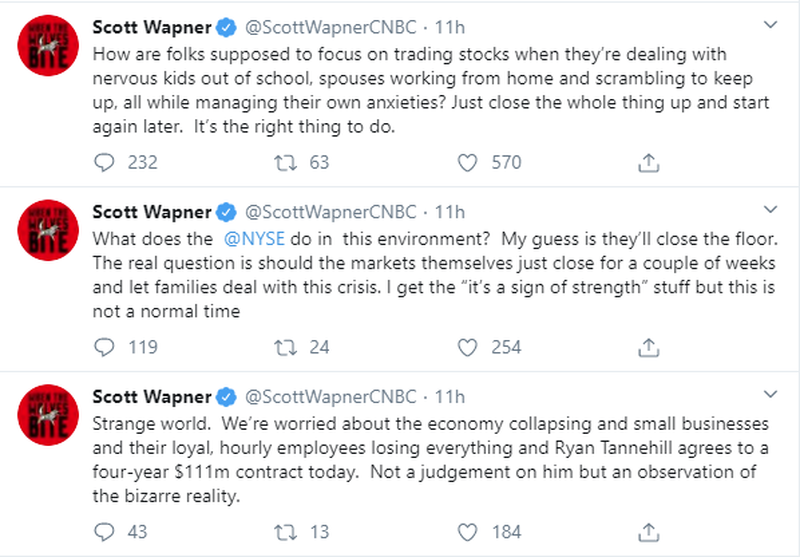

Then, after the Fed bazooka failed to calm markets, it sent the popular talking heads into a typing panic, as Wapner started tweeting wildly, criticizing NFL players for signing contracts, prodding the NYSE to “close the floor” and then begging for them to “close the whole thing up” so the market could “start again later”. Perhaps because when things don’t go your way, you can always beg for a reset in some imaginary world where the Fed still runs everything.

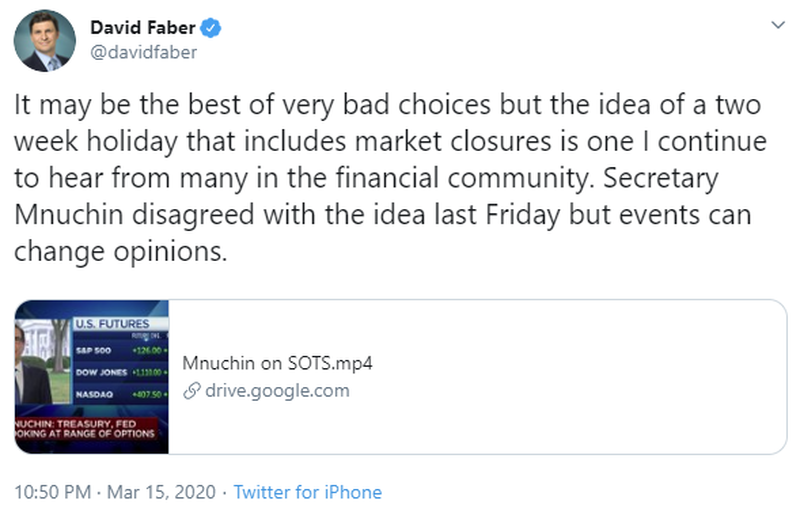

The chorus of CNBC anchors who never mentioned that investing includes risk in addition to return during the last 11 years continued, with David Faber joining his co-worker and also suggesting that markets should go on a “two week holiday”:

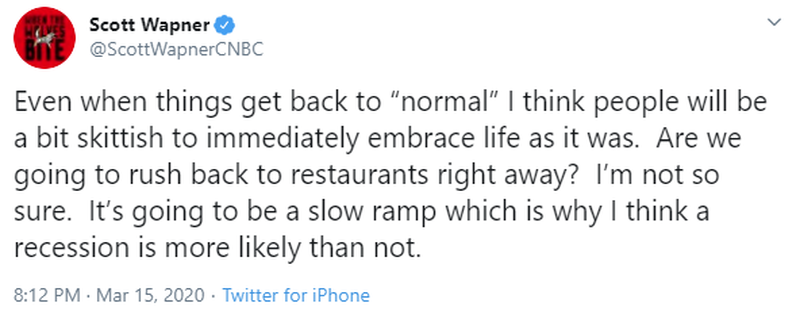

Meanwhile, Wapner had already shifted stages of grief from anger to bargaining, trying to project the image of markets slowly ramping back up, despite the fact that we were still nearly 13 hours away from the next cash open and likely haven’t come anywhere near feeling the full effect of the pain of the Fed’s panicked decision making:

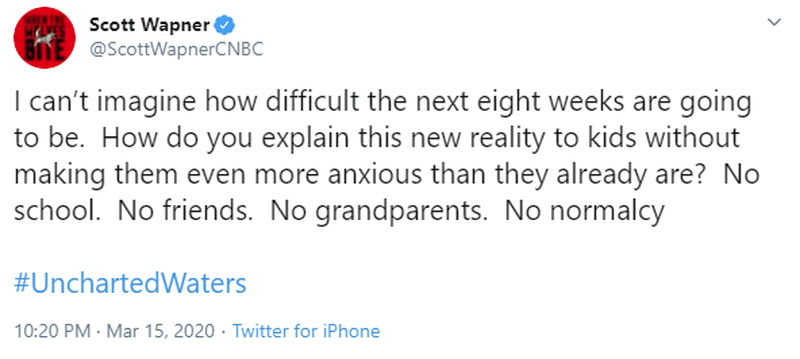

But then it was clear the reality of the situation was finally starting to hit Wapner for the first time in weeks:

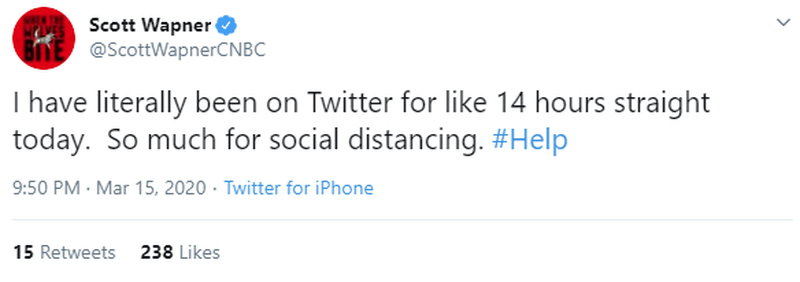

And at one point, Wapner finally appeared to just give up and literally tweeted “Help”:

Forget the idea that closing the markets when they don’t go your way is nothing but a temporary measure to pause price discovery that will eventually happen anyway, one way or another, but the anchors obviously never seemed to consider what the idea of closing the markets could project in term of further panic upon participants.

Participants will find a way to hedge and trade in other markets. The logistical nightmare of expiring options and those needed to liquidate to deleverage as the market falls could cause serious unrest.

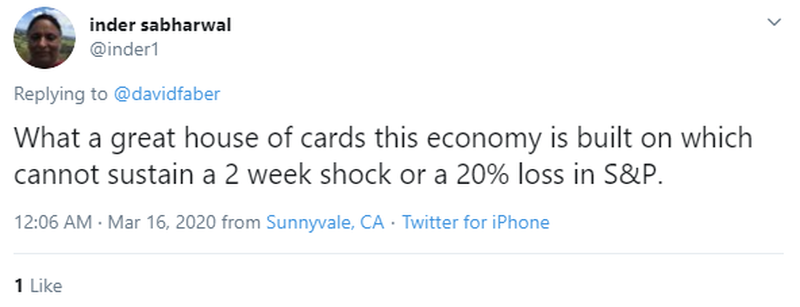

In other words, the thin skin of CNBC’s supposed “financial experts” is (yet again) exacerbating the problem instead of quelling it, as one Twitter user responded to Faber:

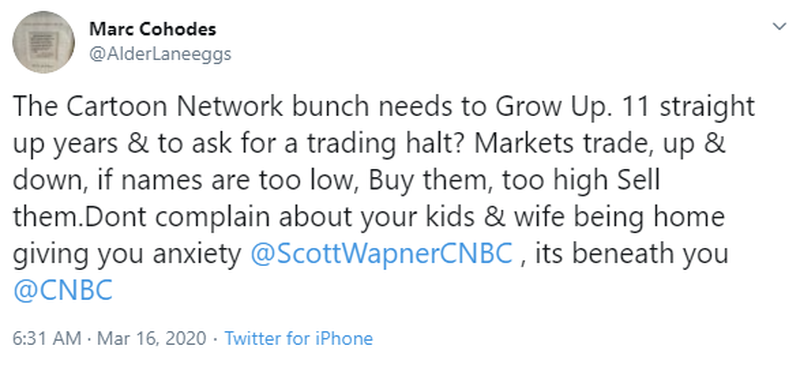

And other well known names in the Financial Twittersphere rung in, too. Short seller Marc Cohodes told Wapner to “grow up” after Wapner pressed for a market shut down:

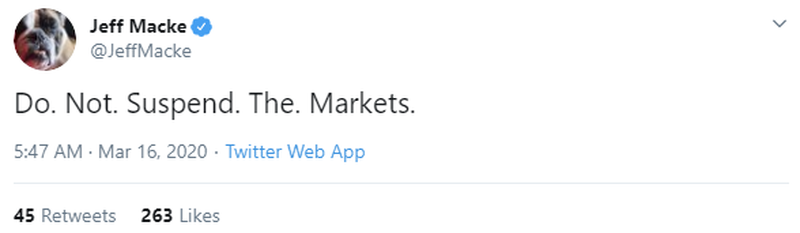

Former CNBC anchor Jeff Macke implored regulators not to suspend the markets:

In response to Wapner’s meltdown about the nation being in “Uncharted Waters”, one Twitter user responded:

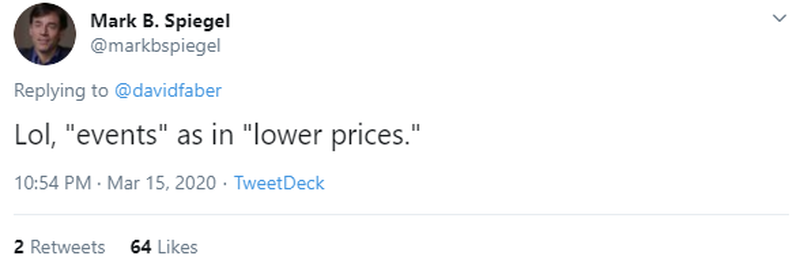

In response to Faber’s comment that “events” can change decisions, Stanphyl Capital’s Mark Spiegel cleared it up for him:

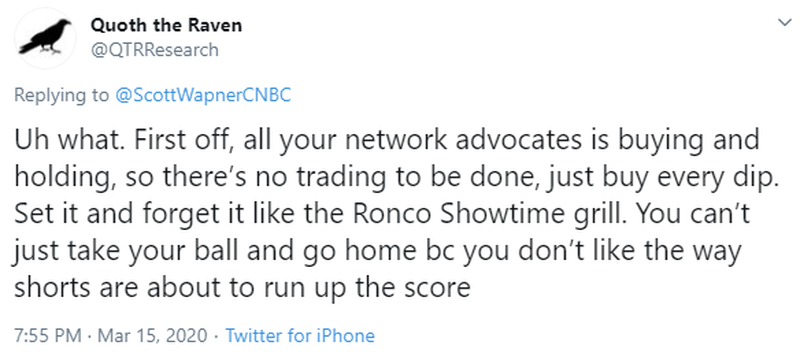

One Twitter user asked Wapner why he would want to close the markets now, with so many buying opportunities abound:

Finally, this blogger seemed to nail the overall essence of the situation:

Read more at: ZeroHedge.com

Tagged Under: CNBC, Collapse, crash, economy, finance, Journalism, market, market crash, panic, risk, stupid, Twitter

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 COLLAPSE.NEWS

All content posted on this site is protected under Free Speech. Collapse.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Collapse.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.