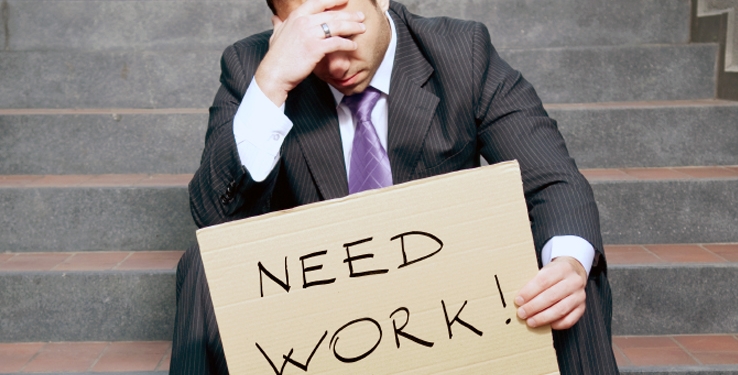

Recession fears surge as new job creation slows down, jobless claims rise

04/07/2023 / By Arsenio Toledo

Investors are once again concerned that the economy of the United States could dip far enough into a recession as recent jobs data shows a slowdown in new job creation and an increase in jobless claims.

According to the Department of Labor‘s report, job openings slipped to 9.9 million in February, the lowest since May 2021. This is also down from a revised 10.6 million new jobs created in the prior month.

Economic analysts note that they expected job creation to slow down drastically this year after 2021 became the best year for job creation on record and 2022 saw the Federal Reserve continuously raise its benchmark interest rate in a bid to corral inflation. This has resulted in a massive slowdown of the economy that the Fed believes is necessary to stop inflation. (Related: American banks are sitting on a TIME BOMB of $1.7 trillion in unrealized losses.)

To add to the concerns of investors, recent reports show stronger-than-expected jobless claims. In the seven days preceding April 1, initial jobless claims totaled 228,000.

This is down from a revised 246,000 from the prior week. However, two weeks ago, the federal government predicted that initial jobless claims would drop to around 198,000.

The massive 48,000 upward revision for the week of March 25 reflects the government’s attempt to change the formula for seasonal adjustments. This change now shows jobless claims to be significantly higher in early 2023 than previously reported, which could reflect the massive wave of corporate layoffs that government reports had not shown in their data previously.

Stocks seeing declines as recession fears rise

Two of America’s main stock indexes, the S&P 500 and the Nasdaq, dropped sharply on Wednesday, April 5, after a growing wave of weak economic data deepened the concerns of the stock market that the U.S. economy might tip into a recession.

The S&P 500 declined by 0.25 percent, ending the session at 4,090.38 points. The Nasdaq fell by 1.07 percent, down to 11,996.86 points.

Of the 11 main sector indexes in the S&P 500, seven declined – Information Technology, Financials, Industrials, Consumer Discretionary, Communication Services, Materials and Real Estate.

“It looks pretty clear that we are going to see parts of the economy break and we are heading for a recession,” warned Edward Moya, a senior market analyst for the Americas at foreign exchange company Oanda Corporation in New York. “We forget that there’s also a banking crisis going on, so there’s going to be some pain that’s really going to cripple small and medium businesses. We are going to see some tough times and are probably going to see this play out in markets.”

“We may have transitioned from the notion that ‘bad news is good news’ to ‘bad news is bad news,'” said Jay Hatfield, chief executive officer and portfolio manager at investment firm InfraCap in New York. “Fear about a recession is the dominant theme.”

Reflecting concerns about the deteriorating state of the economy and the recent turmoil in the banking industry, interest rate futures predict a 61 percent chance that the Fed will cut interest rates from current levels by the end of its meeting in July, implying a desire to jumpstart the economy following over a year of interest rate increases to avoid a recession.

Learn more about the deteriorating state of the American economy at MarketCrash.news.

Watch this clip from “Barron’s Roundtable” on Fox Business as Bank of America Securities Head of U.S. Economics Michael Gapen discusses his predictions for a recession in the United States.

This video is from the News Clips channel on Brighteon.com.

More related stories:

Jobless claims soar to five-month high as recession signals blare.

Dr. Doom warns: Perfect storm of recession, debt crisis and inflation to hit markets.

Biden’s economy: Major companies continue to lay off thousands of workers as recession worsens.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, economic collapse, economics, economy, finance, financial crash, initial jobless claims, job creation, jobless claims, jobs, jobs growth, market crash, recession, recession fears, risk, stocks, unemployment

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 COLLAPSE.NEWS

All content posted on this site is protected under Free Speech. Collapse.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Collapse.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.