Russia avoiding Western sanctions on its oil trade by switching to the CHINESE YUAN and dumping the dollar

10/06/2023 / By Kevin Hughes

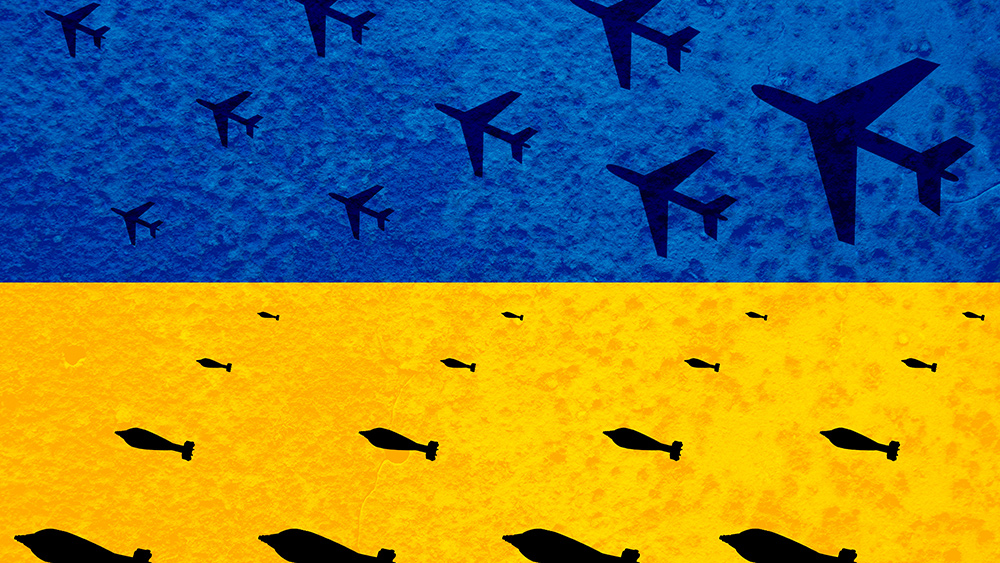

When nations from the West flaunted a big plan to strangle Russian oil imports and enforce sanctions on Moscow’s energy exports, Russia was able to skirt these obstructions by abandoning the dollar and using the Chinese yuan for oil deals.

Russia has successfully avoided most Western-backed sanctions on its oil exports, enhancing Moscow’s crude oil revenue as the price of a barrel rushes toward $100 and as the price of Russian Urals oil hits a year’s record-high of $80 per barrel.

Based on an analysis of shipping and insurance records by the Financial Times, nearly 75 percent of all maritime Russian crude flows journeyed without Western insurance in August, the only leverage employed to impose the Group of Seven’s $60-a-barrel oil price cap. That is an increase from about half this spring.

The hike indicates that Russia is becoming more proficient at bypassing the cap, permitting it to sell more oil at prices closer to international market rates. More significantly, it means that fewer Russian clients are concerned about retaliation from the Western world for buying Russian oil.

Not only is a larger share of Russian oil being sold outside the cap, but the Kremlin’s growing independence as a seller has coincided with a strong rally in oil prices, which reached $95 a barrel for the first time in 13 months.

According to the Kyiv School of Economics (KSE) in Ukraine, the steady rise in crude oil prices since July, together with Russia’s success in maintaining exports while lowering the steep discounts it is offering on its own oil, means that Moscow’s oil revenues are expected to be at least $15 billion higher for 2023 than they would have been.

“Given these shifts in how Russia ships its oil, it may be very difficult to meaningfully enforce the price cap in future. And that makes it even more regrettable that we did not do more to properly enforce it when we had more leverage,” said Ben Hilgenstock, an economist at the KSE.

Moscow’s successes attributable to Chinese yuan

Russia’s most recent successes with regard to its oil trade can, at least in part, be attributed to Moscow’s decision to abandon the dollar as its main trading currency.

By the end of 2022, a full 20 percent of Russian imports were invoiced in the Chinese yuan, a three percent increase from the previous year. This comes as Russia seeks to avoid Western sanctions and as China itself is increasingly using the yuan to settle imports from third countries. Beijing has settled a full five percent of imports using the yuan, an increase from just one percent before the beginning of the conflict in Ukraine in February 2022. (Related: END of DOLLAR’S HEGEMONY: Russian oil giant now using yuan and rubles for export settlements.)

“The yuan is being used as a vehicle currency,” said Beata Javorcik, chief economist of the European Bank for Reconstruction and Development (EBRD). “Russia is now the third-largest clearing center for offshore yuan transactions.”

“Rising geopolitical tensions in general, and the use of trade sanctions in particular, may reduce the attractiveness of the use of the U.S. dollar as a vehicle currency in international trade,” writes the EBRD. “This, in turn, might lead to a greater fragmentation of global payment systems.”

Follow FuelSupply.news for more stories about Russia’s oil exports.

Listen to the Health Ranger Mike Adams discussing Russia’s ban on diesel exports below.

This video is from the Health Ranger Report channel on Brighteon.com.

More related stories:

Russia has almost fully bypassed Western sanctions on oil exports.

Putin bans diesel and gasoline exports, sending distillate fuel oil prices skyrocketing.

EU destroying its industries by shunning Russian energy, official tells RT.

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, China, Chinese yuan, Collapse, conspiracy, crude oil, currency crash, currency reset, dedollarization, dollar demise, energy supply, fuel supply, money supply, Moscow, oil, oil exports, oil trade, risk, Russia, sanctions, Urals crude, Us Dollar, yuan

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 COLLAPSE.NEWS

All content posted on this site is protected under Free Speech. Collapse.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Collapse.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.